Investment Objective/Strategy - The First Trust Core Investment Grade ETF (the "Fund") seeks to maximize long-term total return. Under normal market conditions, the Fund seeks to invest 100% of its Investment Portfolio in investment grade securities. Investment grade securities are those securities that are, at the time of purchase, rated as investment grade (i.e., rated Baa3/BBB- or above) by at least one nationally recognized statistical rating organization ("NRSRO") rating such securities, or if unrated, debt securities determined by the Fund's investment advisor to be of comparable quality. The Fund's Investment Portfolio includes only investment grade securities purchased by the Fund's portfolio managers (the "Investment Portfolio") and does not include uninvested cash or any other Fund asset unconnected to the Fund's intended portfolio, including, but not limited to, accounts receivable or assets received as part of an issuer workout.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | FTCB |

| Fund Type | Mortgage-Backed Securities & Intermediate Term Bond |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33738D788 |

| ISIN | US33738D7883 |

| Intraday NAV | FTCBIV |

| Fiscal Year-End | 07/31 |

| Exchange | NYSE Arca |

| Inception | 11/7/2023 |

| Inception Price | $20.00 |

| Inception NAV | $20.00 |

| Total Expense Ratio* | 0.57% |

* As of 12/2/2024

| Closing NAV1 | $20.96 |

| Closing Market Price2 | $20.99 |

| Bid/Ask Midpoint | $20.99 |

| Bid/Ask Premium | 0.14% |

| 30-Day Median Bid/Ask Spread3 | 0.05% |

| Total Net Assets | $807,110,517 |

| Outstanding Shares | 38,500,002 |

| Daily Volume | 456,152 |

| Average 30-Day Daily Volume | 501,110 |

| Closing Market Price 52-Week High/Low | $21.84 / $20.28 |

| Closing NAV 52-Week High/Low | $21.81 / $20.21 |

| Number of Holdings (excluding cash) | 502 |

| Holding |

Percent |

| Fannie Mae Series 2024-98, Class FG, Variable rate, due 11/25/2054 |

2.27% |

| Freddie Mac FT ZT2264, 4%, due 03/01/2044 |

2.15% |

| Fannie Mae or Freddie Mac TBA, 4%, due 05/01/2052 |

1.97% |

| Freddie Mac FR SD5829, 4.50%, due 10/01/2052 |

1.97% |

| U.S. Treasury Note, 4%, due 12/15/2027 |

1.84% |

| TENN VALLEY AUTHORITY N/C, 5.25%, due 02/01/2055 |

1.63% |

| Fannie Mae FN FS8862, 3.50%, due 05/01/2048 |

1.62% |

| U.S. Treasury Note, 3.875%, due 03/31/2027 |

1.47% |

| U.S. Treasury Note, 4.25%, due 01/15/2028 |

1.36% |

| Freddie Mac Series 5224, Class HL, 4%, due 04/25/2052 |

1.35% |

* Excluding cash.

Holdings are subject to change.

| Weighted Average Effective Duration (Long Positions)8 | 6.78 Years |

| Weighted Average Effective Duration (Short Positions)8 | -0.90 Years |

| Weighted Average Effective Net Duration8 | 5.88 Years |

| Weighted Average Yield-to-Worst9 | 4.83% |

|

Percent |

| Corporate Bonds |

24.39% |

| Agency CMOs |

18.99% |

| U.S. Treasuries |

18.00% |

| Agency Pass-Throughs |

11.88% |

| Non-Agency RMBS |

10.74% |

| ABS |

5.68% |

| TBAs - Long |

5.17% |

| Non-Agency CMBS |

4.85% |

| Agency CMBS |

3.49% |

| Sovereign Agency Debt |

0.88% |

| Cash & Cash Equivalents |

-4.07% |

| Bond Futures - Net | 27.96% |

| Options on Bond Futures - Net | -0.36% |

| Options on Interest Rate Futures - Net | -0.01% |

| TBAs - Short | -3.34% |

| Credit Quality |

Percent |

| Cash & Cash Equivalents |

-4.07% |

| U.S. Treasuries |

18.00% |

| Agency |

40.40% |

| AAA |

18.86% |

| AA |

0.36% |

| AA- |

2.65% |

| A+ |

1.79% |

| A |

1.72% |

| A- |

2.80% |

| BBB+ |

3.73% |

| BBB |

5.59% |

| BBB- |

8.17% |

The ratings are by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody's Investors Service, Inc., Fitch Ratings, DBRS, Inc., Kroll Bond Rating Agency, Inc. or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. A credit rating is an assessment provided by a NRSRO, of the creditworthiness of an issuer with respect to debt obligations. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the fund, and not to the fund or its shares. U.S. Agency and U.S. Agency mortgage-backed securities appear under "Agency". Credit ratings are subject to change.

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

249 |

58 |

--- |

--- |

| Days Traded at Discount |

3 |

2 |

--- |

--- |

|

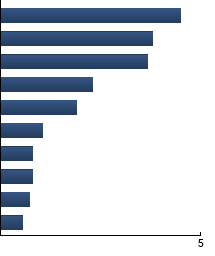

Technology

|

4.51%

|

|

Banking

|

3.80%

|

|

Healthcare

|

3.68%

|

|

P&C

|

2.30%

|

|

Food and Beverage

|

1.90%

|

|

Electric

|

1.06%

|

|

Health Insurance

|

0.80%

|

|

Construction Machinery

|

0.79%

|

|

Packaging

|

0.72%

|

|

Brokerage Asset Managers Exchanges

|

0.55%

|

|

|

Bloomberg US Aggregate Bond Index - The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS. ICE BofA US Broad Market Index - The Index tracks the performance of US dollar denominated investment grade debt publicly issued in the US domestic market, including US Treasury, quasi-government, corporate, securitized and collateralized securities.

|

|