|

|

|

|

Investment Objective/Strategy - The First Trust California Municipal High Income ETF's primary investment objective will be to seek to provide current income that is exempt from regular federal income taxes and California income taxes, and its secondary objective will be long-term capital appreciation. Under normal market conditions, the Fund seeks to achieve its investment objectives by investing at least 80% of its net assets (including investment borrowings) in municipal debt securities that pay interest that is exempt from regular federal income taxes and California income taxes (collectively, "Municipal Securities").

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | FCAL |

| Fund Type | Tax-Free Fixed Income |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33739P863 |

| ISIN | US33739P8639 |

| Intraday NAV | FCALIV |

| Fiscal Year-End | 07/31 |

| Exchange | Nasdaq |

| Inception | 6/20/2017 |

| Inception Price | $50.00 |

| Inception NAV | $50.00 |

| Total Expense Ratio* | 0.65% |

* As of 12/2/2024

| Closing NAV1 | $48.49 |

| Closing Market Price2 | $48.68 |

| Bid/Ask Midpoint | $48.50 |

| Bid/Ask Premium | 0.01% |

| 30-Day Median Bid/Ask Spread3 | 0.47% |

| Total Net Assets | $266,672,226 |

| Outstanding Shares | 5,500,002 |

| Daily Volume | 6,841 |

| Average 30-Day Daily Volume | 13,597 |

| Closing Market Price 52-Week High/Low | $50.51 / $48.68 |

| Closing NAV 52-Week High/Low | $50.44 / $48.49 |

| Number of Holdings (excluding cash) | 327 |

| Holding |

Percent |

| SAN FRANCISCO CALIF CITY & CNTY ARPTS COMMN 5%, due 05/01/2050 |

1.16% |

| CALIFORNIA ST POLL CONTROL FIN AUTH Variable rate, due 07/01/2031 |

1.15% |

| IRVINE CA FACS FING AUTH LEASE REV 5.25%, due 05/01/2048 |

1.15% |

| CALIFORNIA ST POLL CONTROL FIN AUTH Variable rate, due 07/01/2043 |

1.14% |

| SAN FRANCISCO CALIF CITY & CNTY APRTS COMMN 5%, due 05/01/2034 |

1.03% |

| CALIFORNIA ST ENTERPRISE DEV AUTH 5.25%, due 11/01/2049 |

1.02% |

| TURLOCK CA PUBLIC FING AUTH 5%, due 04/01/2045 |

0.99% |

| RIVER ISLANDS CA PUBLIC FING AUTH 4.50%, due 09/01/2053 |

0.89% |

| CALIFORNIA CMNTY CHOICE FING AUTH Variable rate, due 02/01/2052 |

0.84% |

| CALIFORNIA ST HLTH FACS FING AUTH 5%, due 12/01/2045 |

0.82% |

* Excluding cash.

Holdings are subject to change.

| Weighted Average Effective Duration10 | 7.49 Years |

| Weighted Average Modified Duration11 | 5.64 Years |

| Weighted Average Maturity | 15.46 Years |

| Weighted Average Price | $104.75 |

| Weighted Average Coupon | 4.70% |

| Weighted Average Yield-to-Worst12 | 3.82% |

| Years |

Percent |

| Cash |

-0.83% |

| 0 - 0.99 Years |

6.83% |

| 1 - 1.99 Years |

0.68% |

| 2 - 2.99 Years |

2.02% |

| 3 - 3.99 Years |

1.37% |

| 4 - 4.99 years |

3.33% |

| 5 - 5.99 Years |

1.92% |

| 6 - 6.99 Years |

3.06% |

| 7 - 7.99 Years |

1.84% |

| 8 - 8.99 Years |

1.68% |

| 9 - 9.99 Years |

3.80% |

| 10 - 14.99 Years |

13.38% |

| 15 - 19.99 Years |

34.35% |

| 20 - 24.99 Years |

17.38% |

| 25 - 29.99 Years |

8.49% |

| 30 Years & Over |

0.70% |

| Credit Quality |

Percent |

| Cash |

-0.83% |

| AAA |

7.08% |

| AA |

43.68% |

| A |

18.19% |

| BBB |

10.98% |

| BB |

2.62% |

| NR |

17.70% |

| SP-1+/MIG1 (short-term) |

0.58% |

The credit quality information presented reflects the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody's Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

143 |

39 |

--- |

--- |

| Days Traded at Discount |

109 |

19 |

--- |

--- |

|

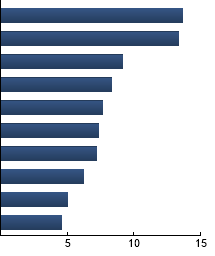

INSURED

|

13.68%

|

|

SPECIAL ASSESSMENT

|

13.37%

|

|

COP

|

9.14%

|

|

GO-UNLTD

|

8.32%

|

|

AIRPORT

|

7.63%

|

|

HOSPITAL

|

7.35%

|

|

IDB

|

7.19%

|

|

EDUCATION

|

6.19%

|

|

WATER & SEWER

|

5.01%

|

|

GAS

|

4.59%

|

|

|

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FCAL |

6.76% |

-0.59 |

0.94 |

-0.46 |

0.98 |

| Bloomberg 10 Year California Exempt Index |

6.96% |

--- |

1.00 |

-0.38 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Bloomberg 10 Year California Exempt Index - The Index is the subset of bonds of the Bloomberg Municipal Bond Index that were issued by California issuers and have 10 years to maturity. Bloomberg Municipal Bond Index - The Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|