|

|

|

|

-

2024 Estimated Capital Gain Distributions

Certain First Trust First Trust Exchange-Traded Funds are expected to pay a long-term capital gain distribution in December. For a list of exchange-traded funds expected to pay a long-term capital gain distribution, please click here. Also, certain First Trust Exchange-Traded Funds are expected to pay short-term capital gain distributions in December. For a list of exchange-traded funds expected to pay a short-term capital gain distribution, please click here. Final determination of the source and tax status of all distributions paid in the current year are to be made after year-end and could differ from the expectations noted above.

Investment Objective/Strategy - The FT Energy Income Partners Enhanced Income ETF (the "Fund") seeks a high level of total return with an emphasis on current distributions paid to shareholders. Under normal market conditions, the Fund will pursue its investment objective by investing primarily in a portfolio of equity securities in the broader energy market.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | EIPI |

| Fund Type | Energy |

| Fund Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | Energy Income Partners, LLC |

| CUSIP | 33740F276 |

| ISIN | US33740F2763 |

| Intraday NAV | EIPIIV |

| Fiscal Year-End | 11/30 |

| Exchange | NYSE Arca |

| Inception | 9/27/2011 |

| Inception Price | $20.00 |

| Inception NAV | $19.10 |

| Total Expense Ratio* | 1.10% |

* As of 5/6/2024

| Closing NAV1 | $20.49 |

| Closing Market Price2 | $20.44 |

| Bid/Ask Midpoint | $20.45 |

| Bid/Ask Discount | 0.20% |

| 30-Day Median Bid/Ask Spread3 | 0.10% |

| Total Net Assets | $990,325,570 |

| Outstanding Shares | 48,335,552 |

| Daily Volume | 79,042 |

| Average 30-Day Daily Volume | 88,229 |

| Closing Market Price 52-Week High/Low | $20.44 / $15.85 |

| Closing NAV 52-Week High/Low | $20.49 / $16.74 |

| Number of Holdings (excluding cash) | 95 |

| Holding |

Percent |

| Enterprise Products Partners L.P. |

8.83% |

| ONEOK, Inc. |

6.50% |

| Energy Transfer LP |

6.09% |

| MPLX LP |

4.24% |

| Kinder Morgan, Inc. |

4.18% |

| DT Midstream, Inc. |

3.68% |

| The Williams Companies, Inc. |

3.47% |

| TotalEnergies SE (ADR) |

3.28% |

| Public Service Enterprise Group Incorporated |

3.09% |

| Plains GP Holdings, L.P. (Class A) |

3.08% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $518,833 |

| Median Market Cap. | $24,245 |

| Minimum Market Cap. | $715 |

| Price/Earnings | 15.26 |

| Price/Book | 2.12 |

| Price/Cash Flow | 7.34 |

| Price/Sales | 0.89 |

Market cap and price ratio statistics are for the equity portion of the fund and exclude cash and options.

| Average Time Until Expiration of Calls | 37 Days |

| Average Call Moneyness (OTM) | 4.52% |

| Option Overwrite % | 45.54% |

Moneyness is how much an option contract's strike price is in-the-money (ITM) or out-of-the-money (OTM) expressed as a percentage of the price of the option contract's underlying asset.

|

|

2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

| Days Traded at Premium |

0 |

0 |

7 |

9 |

| Days Traded at Discount |

0 |

0 |

31 |

55 |

|

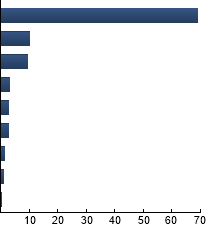

Oil, Gas & Consumable Fuels

|

68.89%

|

|

Multi-Utilities

|

10.07%

|

|

Electric Utilities

|

9.44%

|

|

Energy Equipment & Services

|

3.15%

|

|

Independent Power and Renewable Electricity Producers

|

2.94%

|

|

Gas Utilities

|

2.92%

|

|

Construction & Engineering

|

1.40%

|

|

Chemicals

|

0.93%

|

|

Water Utilities

|

0.26%

|

|

|

Alerian MLP Index - The Index is a float-adjusted, capitalization weighted composite of the 27 most prominent energy Master Limited Partnerships (MLPs). Blended Benchmark - The Benchmark consists of the following two indices: 50% of the PHLX Utility Sector Index which is a market capitalization weighted index composed of geographically diverse public U.S. utility stocks; and 50% of the Alerian MLP Total Return Index which is a float-adjusted, capitalization weighted composite of the 27 most prominent energy Master Limited Partnerships (MLPs). The Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above. PHLX Utility Sector Index - The Index is a market capitalization weighted index composed of geographically diverse public U.S. utility stocks. S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. S&P Global 1200 Energy Index - The Index consists of all members of the S&P Global 1200 that are classified within the GICS energy sector.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|