|

|

|

|

Investment Objective/Strategy - The First Trust SMID Capital Strength ETF (the "Fund") seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an equity index called The SMID Capital Strength Index (the "Index"). The Fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in the securities that comprise the Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- A security must be a constituent of the Nasdaq US Small Cap Index (“small cap securities”) or the Nasdaq US Mid Cap Index (“mid cap securities”).

- To be eligible for inclusion in the index, a security must meet the size, float and liquidity requirements of the index, as well as the following criteria:

- Have at least $100 million USD in cash or short-term investments.

- Have a long-term debt to market cap ratio less than 30%.

- Have positive shareholder equity.

- Have a return on equity greater than 15%

- Eligible securities are ranked based on a combined short-term (3 months) and long-term (12 months) realized volatility score.

- Within each industry, as defined by the Industry Classification Benchmark, the 30 securities with the lowest combined volatility score are retained.

- The universe of eligible securities is further reduced to the 50 small cap and 75 mid cap securities with the lowest combined score.

- From these securities, the 100 securities with the lowest combined volatility score are selected.

- The securities are equally weighted.

- The index is reconstituted and rebalanced on a quarterly basis.

| Ticker | FSCS |

| Fund Type | Small Cap and Mid Cap Equity |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33738R753 |

| ISIN | US33738R7531 |

| Intraday NAV | FSCSIV |

| Fiscal Year-End | 03/31 |

| Exchange | Nasdaq |

| Inception | 6/20/2017 |

| Inception Price | $19.78 |

| Inception NAV | $19.78 |

| Rebalance Frequency | Quarterly |

| Total Expense Ratio* | 0.60% |

* As of 6/10/2024

| Closing NAV1 | $34.35 |

| Closing Market Price2 | $34.43 |

| Bid/Ask Midpoint | $34.35 |

| Bid/Ask Discount | 0.01% |

| 30-Day Median Bid/Ask Spread3 | 0.34% |

| Total Net Assets | $25,764,389 |

| Outstanding Shares | 750,002 |

| Daily Volume | 7,585 |

| Average 30-Day Daily Volume | 5,175 |

| Closing Market Price 52-Week High/Low | $38.40 / $30.82 |

| Closing NAV 52-Week High/Low | $38.35 / $30.82 |

| Number of Holdings (excluding cash) | 100 |

| Holding |

Percent |

| InterDigital, Inc. |

1.29% |

| W.R. Berkley Corporation |

1.26% |

| Skyward Specialty Insurance Group, Inc. |

1.24% |

| Cboe Global Markets, Inc. |

1.21% |

| Genpact Limited |

1.17% |

| McCormick & Company, Incorporated |

1.17% |

| Casey's General Stores, Inc. |

1.16% |

| Chemed Corporation |

1.15% |

| Laureate Education, Inc. (Class A) |

1.15% |

| Rollins, Inc. |

1.15% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $33,132 |

| Median Market Cap. | $10,870 |

| Minimum Market Cap. | $1,392 |

| Price/Earnings | 17.96 |

| Price/Book | 3.79 |

| Price/Cash Flow | 14.32 |

| Price/Sales | 2.12 |

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

206 |

54 |

--- |

--- |

| Days Traded at Discount |

46 |

5 |

--- |

--- |

|

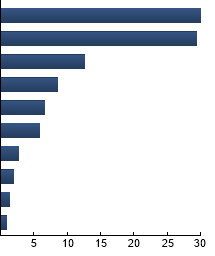

Financials

|

30.06%

|

|

Industrials

|

29.43%

|

|

Consumer Discretionary

|

12.67%

|

|

Consumer Staples

|

8.55%

|

|

Technology

|

6.54%

|

|

Health Care

|

5.92%

|

|

Basic Materials

|

2.77%

|

|

Energy

|

1.91%

|

|

Telecommunications

|

1.29%

|

|

Utilities

|

0.86%

|

|

|

Tracking Index: The SMID Capital Strength Index

Nasdaq Riskalyze US Mid Cap™ Index - The Index is a modified market capitalization weighted index which seeks to provide a diversified portfolio of dividend-paying US mid cap securities. Nasdaq US 600 Mid Cap™ Index - The Index is a float modified market capitalization weighted index that contains the 600 securities from the mid cap segment of the NASDAQ US Benchmark™ Index. Russell 2500™ Index - The Index is an unmanaged market-cap weighted index that includes the smallest 2,500 companies from the Russell 3000 Index. Russell 3000® Index - The Index is comprised of the 3000 largest and most liquid stocks based and traded in the U.S. S&P MidCap 400® Index - The Index is an unmanaged index of 400 stocks used to measure mid cap U.S. stock market performance.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|