|

|

|

|

Investment Objective/Strategy - The First Trust Emerging Markets Human Flourishing ETF (the "Fund") seeks investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the Emerging Markets Human Flourishing Index (the "Index"). The Fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in the securities that comprise the Index. The Fund, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- The Emerging Markets Human Flourishing Index is constructed to track the performance of companies that belong to countries within emerging markets that have a high “Human Dignity Score” according to Freedom House. Freedom House is a non-profit, majority U.S. government funded organization in Washington, D.C., that conducts research and advocacy on democracy, political freedom, and human rights.

- Eligible securities must be a member of the Bloomberg Emerging Markets Large and Mid Cap universe.

- Each security must meet the market capitalization and liquidity standards of the index and be issued by a company domiciled in a country that has a sufficient Human Dignity Score.

- A Human Dignity Score is generated by evaluating emerging market countries on data points sourced by Freedom House based on:

- Freedom of Expression and Belief (80%): Refers to the extent in which a particular country has free and independent media, allows for individuals to practice and express their religious faith, has academic freedom, and allows individuals to express their personal views on political or other sensitive topics.

- Freedom from Religious Persecution (20%): Refers to the degree to which laws, policies, and practices of a particular country guarantee equal treatment of various segments of the population.

- Only those securities that are issued by companies domiciled in countries that score in the top 50th percentile of the Human Dignity Score rankings are included in the index. These securities are then screened to exclude companies associated with seven defined controversial practices.

- The top 150 securities ranked by free float market capitalization are selected.

- Of the top 150 securities, the 100 securities with the highest “Quality Score”, which is derived from a factor-based analysis of a security’s variability, profitability, and leverage are selected.

- Selected securities are weighted based on a combination of a modified free-float market capitalization, a country exposure cap and a sector exposure cap.

- The index is reconstituted and rebalanced semi-annually.

| Ticker | FTHF |

| Fund Type | Emerging Market Equity |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33734X747 |

| ISIN | US33734X7479 |

| Intraday NAV | FTHFIV |

| Fiscal Year-End | 09/30 |

| Exchange | NYSE Arca |

| Inception | 10/30/2023 |

| Inception Price | $20.00 |

| Inception NAV | $20.00 |

| Rebalance Frequency | Semi-Annual |

| Total Expense Ratio* | 0.75% |

* As of 2/3/2025

| Closing NAV1 | $22.62 |

| Closing Market Price2 | $22.55 |

| Bid/Ask Midpoint | $22.55 |

| Bid/Ask Discount | 0.31% |

| 30-Day Median Bid/Ask Spread3 | 0.36% |

| Total Net Assets | $39,583,455 |

| Outstanding Shares | 1,750,002 |

| Daily Volume | 5,049 |

| Average 30-Day Daily Volume | 2,033 |

| Closing Market Price 52-Week High/Low | $24.74 / $20.98 |

| Closing NAV 52-Week High/Low | $24.73 / $21.17 |

| Number of Holdings (excluding cash) | 100 |

| Holding |

Percent |

| Taiwan Semiconductor Manufacturing Company Ltd. |

7.74% |

| Samsung Electronics Co., Ltd. |

7.19% |

| Gold Fields Limited |

4.26% |

| Itau Unibanco Holding S.A. (Preference Shares) |

3.57% |

| Walmart de Mexico, S.A.B. de C.V. |

3.30% |

| WEG S.A. |

2.75% |

| ORLEN SA |

2.38% |

| Grupo Financiero Banorte, S.A.B. de C.V. |

2.32% |

| FirstRand Limited |

2.06% |

| Powszechna Kasa Oszczednosci Bank Polski S.A. |

1.92% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $819,833 |

| Median Market Cap. | $11,075 |

| Minimum Market Cap. | $4,101 |

| Price/Earnings | 12.03 |

| Price/Book | 1.58 |

| Price/Cash Flow | 8.46 |

| Price/Sales | 1.45 |

| Country |

Percent |

| Taiwan |

19.98% |

| South Africa |

18.29% |

| South Korea |

18.07% |

| Brazil |

16.01% |

| Poland |

10.41% |

| Mexico |

8.32% |

| Philippines |

4.78% |

| Czech Republic |

1.82% |

| Greece |

1.67% |

| Chile |

0.65% |

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

154 |

9 |

--- |

--- |

| Days Traded at Discount |

98 |

50 |

--- |

--- |

|

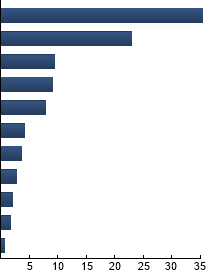

Financials

|

35.35%

|

|

Information Technology

|

23.00%

|

|

Consumer Staples

|

9.51%

|

|

Industrials

|

9.06%

|

|

Materials

|

7.94%

|

|

Utilities

|

4.19%

|

|

Energy

|

3.65%

|

|

Consumer Discretionary

|

2.74%

|

|

Health Care

|

2.15%

|

|

Communication Services

|

1.79%

|

|

Real Estate

|

0.62%

|

|

|

Tracking Index: Emerging Markets Human Flourishing Index

MSCI Emerging Markets Index - The Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|