|

|

|

|

Investment Objective/Strategy - The First Trust North American Energy Infrastructure Fund is an actively managed exchange-traded fund. The Fund's investment objective is to seek total return. The Fund's investment strategy emphasizes current distributions and dividends paid to shareholders. Under normal market conditions, the Fund will invest at least 80% of its net assets (including investment borrowings) in equity securities of companies deemed by Energy Income Partners, LLC, the Fund's investment sub-advisor, to be engaged in the energy infrastructure sector. These companies principally include U.S. and Canadian natural gas and electric utilities, corporations operating energy infrastructure assets such as pipelines or renewable energy production, utilities, publicly-traded master limited partnerships or limited liability companies taxed as partnerships ("MLPs"), MLP affiliates, and other companies that derive the majority of their revenues from operating or providing services in support of infrastructure assets such as pipelines, power transmission and petroleum and natural gas storage in the petroleum, natural gas and power generation industries (collectively, "energy infrastructure companies"). The Fund will invest principally in energy infrastructure companies. In addition, under normal market conditions, the Fund will invest at least 80% of its net assets (including investment borrowings) in equity securities of companies headquartered or incorporated in the United States and Canada. The Fund may invest in equity securities of MLPs without limit; however, in order to comply with applicable tax diversification rules, the Fund may directly invest up to 25% of its total assets in equity securities of certain MLPs treated as publicly-traded partnerships.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | EMLP |

| Fund Type | Energy |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | Energy Income Partners, LLC |

| CUSIP | 33738D101 |

| ISIN | US33738D1019 |

| Intraday NAV | EMLPIV |

| Fiscal Year-End | 10/31 |

| Exchange | NYSE Arca |

| Inception | 6/20/2012 |

| Inception Price | $19.99 |

| Inception NAV | $19.99 |

| Total Expense Ratio* | 0.95% |

* As of 3/3/2025

The Investment Advisor has implemented fee breakpoints, which reduce the fund's investment management fee at certain assets levels. Please see the fund's Statement of Additional Information for full details.

| Closing NAV1 | $36.36 |

| Closing Market Price2 | $36.35 |

| Bid/Ask Midpoint | $36.37 |

| Bid/Ask Premium | 0.03% |

| 30-Day Median Bid/Ask Spread (as of 3/12/2025)3 | 0.05% |

| Total Net Assets | $3,144,906,819 |

| Outstanding Shares | 86,505,000 |

| Daily Volume | 144,797 |

| Average 30-Day Daily Volume | 371,095 |

| Closing Market Price 52-Week High/Low | $38.28 / $28.25 |

| Closing NAV 52-Week High/Low | $38.23 / $28.29 |

| Number of Holdings (excluding cash) | 67 |

| Holding |

Percent |

| Energy Transfer LP |

7.68% |

| Enterprise Products Partners L.P. |

7.42% |

| Plains GP Holdings, L.P. (Class A) |

5.09% |

| MPLX LP |

4.93% |

| ONEOK, Inc. |

3.66% |

| Sempra |

3.62% |

| National Fuel Gas Company |

3.35% |

| Kinder Morgan, Inc. |

3.27% |

| The Southern Company |

2.62% |

| American Electric Power Company, Inc. |

2.46% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

Among 94 funds in the Energy Limited Partnership category. This fund was rated 2 stars/94 funds (3 years), 4 stars/92 funds (5 years), 5 stars/64 funds (10 years) based on risk adjusted returns.

Among 94 funds in the Energy Limited Partnership category. This fund was rated 2 stars/94 funds (3 years), 4 stars/92 funds (5 years), 5 stars/64 funds (10 years) based on risk adjusted returns.

| Maximum Market Cap. | $144,342 |

| Median Market Cap. | $22,383 |

| Minimum Market Cap. | $846 |

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

124 |

42 |

--- |

--- |

| Days Traded at Discount |

128 |

6 |

--- |

--- |

|

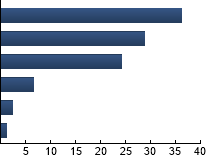

Electric Power & Transmission

|

36.22%

|

|

Petroleum Product Transmission

|

28.74%

|

|

Natural Gas Transmission

|

24.12%

|

|

Crude Oil Transmission

|

6.66%

|

|

Nat. Gas Gathering & Processing

|

2.44%

|

|

Propane

|

1.16%

|

|

|

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| EMLP |

15.74% |

0.52 |

0.95 |

0.82 |

0.95 |

| S&P 500® Index |

16.95% |

-1.49 |

0.82 |

0.55 |

0.77 |

| Blended Benchmark |

15.74% |

--- |

1.00 |

0.83 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Blended Benchmark - The Benchmark consists of the following two indices: 50% of the PHLX Utility Sector Index which is a market capitalization weighted index composed of geographically diverse public U.S. utility stocks; and 50% of the Alerian MLP Total Return Index which is a float-adjusted, capitalization weighted composite of the 27 most prominent energy Master Limited Partnerships (MLPs). The Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|